ARB Apex Bank admitted to Ghana-Sweden Chamber of Commerce

She added that “key areas of our partnership interventions include, “women empowerment, capacity building and training, and we are happy to help bring the needed support especially because of the wide network of branches of the banks.”

GSCC is a non-profit umbrella organisation that promotes bilateral relationships in Business, Trade, Technology and Innovation, Education, Sports, Culture, etc., between Ghanaian and Swedish businesses. Businesses and individuals are required to be members of the organisation before such bilateral partnerships are promoted.

Benefits to Banks

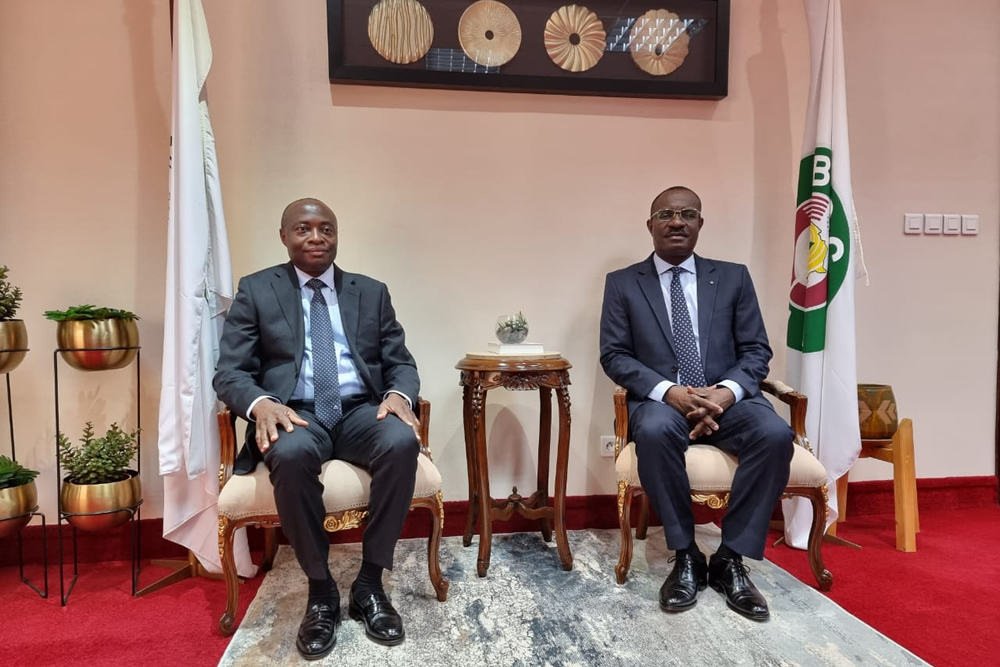

Kojo Mattah, Managing Director of ARB Apex Bank who received the certificate on behalf of the Bank stressed that “we shall ensure membership of the Chamber benefits our member banks.”

He indicated that through initial engagements which led to “our admission to the Chamber, the Bank has started reaping some benefits as a member of the Chamber, an Information Communications Technology Solutions firm, has already offered to provide a Cybersecurity solution to the Bank at a highly subsidized cost.”

This solution would support the Bank in ensuring the confidentiality and integrity of transactions performed on its electronic platforms as part of the Bank of Ghana’s Cyber and Information Security Directive.

The COVR Security solution was provided by the Swiss-based company as part of their Corporate Social Responsibility in recognition of the role ARB Apex Bank plays in serving the RCBs in driving the financial inclusion agenda of government in the deprived areas of the country.

COVR Security is a Swedish Technology Company that provides mobile multi-customer authentication for Banks, Payment Networks, and Credit Card Companies throughout the world. They are represented in Ghana by Floodgate Limited.

They are hoping to use their partnership with ARB Apex Bank and the RCBs in Ghana as a springboard into other countries in the West African sub-region.